In today’s fast-paced real estate market, the phrase “we buy houses ripoff” has become all too familiar for many homeowners. “We Buy Houses for Cash!” is written on bright signs. It’s hard to miss and even harder to ignore them, especially if you need to sell your house quickly.

Some cash for houses scams exist, but most of these offers are real and can help people sell their homes quickly and easily. It is important to know the difference between the two so you don’t get ripped off. Learn the difference between real and fake when you read our full guide One of your most valuable things is your home, so make sure you give it to the right people.

Key Takeaways

- Fast cash offers can disguise “we buy houses ripoffs.”

- Real investors uplift communities; scammers pressure sellers.

- “No-obligation” offers let homeowners explore without commitment.

- Knowledge and caution are key to selling your home safely.

- Sell fast but smartly, using reputable cash buyers.

Some cash for houses scams exist, but most of these offers are real and can help people sell their homes quickly and easily. It is important to know the difference between the two so you don’t get ripped off. Learn the difference between real and fake when you read our full guide One of your most valuable things is your home, so make sure you give it to the right people.

What is the 'We Buy Houses Ripoff'?

The “We Buy Houses” ripoff refers to schemes by certain companies or individuals who claim to pay cash for houses fast.

These offers might seem tempting, especially to distressed homeowners or in urgent need of money.

However, there are some common pitfalls:

- Below Market Value Offers: Many buyers offer prices significantly below market value, taking advantage of homeowners’ desperation or lack of market knowledge.

- Hidden Fees: Some companies may have hidden fees or costs deducted from the final purchase price, leaving the seller with much less than anticipated.

- Misleading Terms: Some deals might be structured in complex ways, with contracts that are hard to understand, locking sellers into unfavorable terms.

- Last-minute Changes: There have been instances where the cash homebuyer changed the offer at the last minute, putting the seller in a tight spot.

- Scams and Frauds: In the worst cases, some “We Buy Houses” operations might be complete scams, where fraudsters have no intention of buying but aim to extract money or sensitive information.

The Allure of the Cash Offer

The idea of a cash deal is very attractive to many sellers in the fast-paced world of real estate. Why? Let’s take a better look:

- Speed: Traditional property sales can take weeks or even months. Cash offers, on the other hand, often close within days. This expedited process can be especially attractive to those in urgent need, such as homeowners facing foreclosure or those needing to relocate quickly.

- Certainty: Cash offers reduce the chances of last-minute fall-throughs that can occur in traditionally financed deals. When a buyer relies on mortgage approval, there’s always a risk the loan won’t be approved, derailing the sale. Selling your home for cash eliminates this uncertainty.

- Simplicity: Cash transactions often involve fewer complexities. There’s no need for appraisals demanded by lenders, which can be a relief for homes that may not be in prime condition.

- Fewer Contingencies: Cash buyers often present offers with fewer contingencies, making the sale process smoother. There’s less haggling over repairs or updates.

- Attractive in Competitive Markets: In hot real estate markets, sellers might receive multiple offers. Cash offers often stand out due to their speed and certainty, giving cash buyers an edge.

But it’s important to be careful when looking at cash deals. There’s no denying the appeal, but sellers should ensure they get a good price and watch out for scams.

Common House Buying Scams Often Encountered

People who are dishonest and want to make quick money are drawn to home buying, where a potentially large amount of money is exchanged.

As “we buy houses for cash” and other cash offers become more popular, so do the number of cash for home scams that target homeowners who don’t know what’s going on. Let’s look at some of the most popular house-buying scams and figure out how they work.

The Bait and Switch

One of the oldest tricks in the book, this scam involves a cash buyer making a promise an all-cash offer attractive to the home seller. However, just before closing, they’ll come up with reasons to significantly lower the offer, hoping the seller, already invested in the sale, will agree to the reduced price. This tactic preys on the homeowner’s urgency to sell quickly.

Equity Skimming or “Subject-To” Scam

In this scam, the scammer convinces the homeowner to transfer the deed of the house, promising to take over the mortgage payments. Once the deed is transferred, the scammer rents out the property without paying off the mortgage, leading the original homeowner into deeper financial trouble.

Fake Legal Work

Some scammers go to great lengths, creating counterfeit documents to appear legitimate. They might present homeowners with fake contracts or deeds, leading them to believe they’ve sold their home when, in reality, they haven’t.

Rental Scams

In this scenario, the scammer, without buying the property, poses as the landlord and rents it out to unsuspecting tenants. They collect deposits and rents until the real homeowner or a real estate agent puts the house on the market, leaving the tenants in a lurch.

Phantom Offers

Here, potential buyers or their agents might hint at a very generous offer on your home, only if the homeowner signs a document or pays a fee upfront. Once the homeowner commits, the generous offer falls significantly or disappears.

Out-of-Country Buyers

A so-called buyer claims to be from out of the country and expresses a keen interest in purchasing the property without viewing it. They’ll send a check overpaying the amount and ask the homeowner to refund the difference. By the time the homeowner realizes the check is fake, they’ve already lost the money they refunded.

The impact of these scams often goes beyond financial loss. Homeowners can face severe emotional distress, legal complications, and even potential foreclosure in some cases.

These scams often come to light when homeowners begin receiving foreclosure notices, find discrepancies in paperwork, or when new “owners” or tenants show up at their doorstep.

Signs of a 'We Buy Houses' Scam

To safeguard your interests, it's crucial to recognize the signs of a potential scam. Here are some red flags to watch out for:

-

Too Good to Be True Offers

If a cash buyer makes an offer that seems unrealistically high, especially without inspecting the property, it’s a clear warning sign. Scammers use this tactic to lure homeowners into a false sense of security, only to lower the offer drastically later on or introduce hidden fees.

-

Upfront Fees

Legitimate cash home buyers or real estate investors will disclose fees upfront. If a cash buyer requests money for “processing,” “administration,” or any other reasons before buying your home, make sure it’s clear how the funds will be used to help you avoid being scammed.

-

Lack of Transparency

A genuine cash buyer will be transparent about their intentions, the process, and the terms of the sale. If they’re evasive, unwilling to answer questions, or provide vague contract terms, proceed with caution.

-

No Physical Office

While many companies that buy houses operate online, a cash home buyer without a physical office or local presence can be a red flag. It’s essential to verify their business address and consider meeting in person before making any decisions.

-

Pressure Tactics

Scammers often employ urgency tactics to rush homeowners into decisions. Phrases like “this offer is only valid for 24 hours” or “you need to decide now” are tactics to prevent you from taking the time to think or consult with others.

-

Inconsistent Stories or Details

If the buyer provides inconsistent information about their identity, company, or the reason for buying, it’s a warning sign. Always trust your instincts and verify any claims or stories they present.

-

Absence of Online Presence or Reviews

In today’s digital age, most legitimate businesses have an online presence and customer reviews. If you can’t find any information or reviews about the cash buyer or if all the reviews are overly positive without any criticism, it might be a cause for concern.

-

Request for Personal Information

Be wary of buyers who ask for personal or financial information without a clear reason. Scammers can use this information for identity theft or other fraudulent activities.

The Role of the Real Estate Agent vs. Cash Home Buyer

Both avenues come with their own set of advantages and challenges. Let's break down the roles of each and weigh the pros and cons to help homeowners make an informed choice.

Real Estate Agent

A real estate agent acts as an intermediary between the seller and potential buyers. They have a deep understanding of the market, can provide pricing strategies, and offer a wide range of services to facilitate the sale.

Pros

- Market Expertise: Agents have a pulse on the current market trends, ensuring homes are priced competitively.

- Negotiation Skills: With their experience, agents can negotiate offers to get the best possible price for the homeowner.

- Marketing and Exposure: Agents can list the property on multiple platforms, conduct open houses, and use their network to attract a broader range of potential buyers.

- Guidance: From staging the home to navigating the complexities of contracts, agents provide advice every step of the way.

Cons

- Commission Fees: Typically, agents charge a commission, a percentage of the sale price.

- Time-Consuming: The traditional route can be lengthy, especially if the market is slow or the property needs to attract buyers quickly.

- Uncertainties: There needs to be a guarantee of when the house will sell or if the offers meet the homeowner’s expectations.

Cash Home Buyer

A cash home buyer is an individual or company ready to purchase a property directly from the homeowner without the need for traditional financing.

Pros

- Speed: One of the most significant advantages is the quick sale process. Deals can often close within a week.

- Convenience: There’s no need for staging, open houses, or multiple showings.

- Guaranteed Sale: Once an agreement is reached, the sale is almost guaranteed, barring any unforeseen legal issues.

- As-Is Purchase: Many cash buyers purchase properties in their current condition, eliminating the need for repairs or renovations.

Cons:

- Lower Offers: To account for the speed and convenience, offers from cash buyers might be below the market value.

- Less Competition: Unlike the traditional listing process, where multiple buyers might drive up the price, here the negotiation is with a single entity.

- Potential for Scams: As discussed earlier, the rise of the “we buy houses for cash” trend has also seen an increase in scams. Homeowners need to be cautious and conduct due diligence.

How to Sell Your House Fast Without Falling for Scams

Real estate experts should be consulted at all times to help weigh the benefits and drawbacks in light of individual circumstances.

Here are some actionable tips to ensure a swift, safe, and satisfactory sale:

Tip 1: Do Your Homework

Find out what the local market is like before you get into a transaction. Find out how long similar houses often stay on the market, how much they typically sell for, and how much demand there is in your area. With this information, you’ll have something to use as a yardstick when comparing different bids.

Tip 2: Vet Your Buyers

Whether it’s a cash buyer or a traditional one, always vet them. Check for online reviews, ask for references, and verify their credentials. A reputable cash buyer will have a track record that speaks for itself.

Tip 3: Avoid Upfront Fees

As was previously indicated, genuine purchasers (whether they be represented by an agent or paying cash) won’t ask for any fees up front. Warning signs include anyone asking for money up front to assess or analyze your home.

Tip 4: Get Everything in Writing

From offers to agreements, ensure everything is documented. A written record not only provides clarity but also serves as evidence should any disputes arise.

Tip 5: Consult Professionals

Even if you’re selling to a cash buyer, consider consulting a lawyer to review contracts or legal documents. Their expertise can help you navigate potential pitfalls.

Tip 6: Trust Your Instincts

Your gut instincts are usually correct. You should always listen to your instincts, whether they pertain to the buyer’s actions, the deal’s terms, or the rate of progress.

Tip 7: Understand the Value of Your Home

Know your home’s fair market value before you consider any offer. Having this knowledge can aid you in negotiations and ensure you are well-prepared.

Tip 8: Engage with Reputable Cash Buyers

Many reputable cash buyers in the industry offer fair deals and transparent processes. Engaging with such entities can provide the speed of a cash sale without the associated risks.

Tip 9: Be Wary of Pressure Tactics

A genuine buyer, understanding the gravity of a home sale will give you the time you need to make decisions. Be cautious of anyone trying to rush you.

Tip 10: Use External Resources

Use websites that provide reviews and ratings of home-buying services that pay cash. The trustworthiness and standing of prospective buyers might be gauged through such channels.

Learning About the Cash Offer With No Obligation

Let's go into the idea and see what it means for vendors.

-

The True Meaning of “No-Obligation”

When a cash buyer presents a “no-obligation cash offer,” the homeowner is under no contractual obligation to accept the proposal. In simpler terms, it’s a risk-free way for homeowners to see what they could get for their property without committing to the sale.

-

Freedom to Explore Options

The beauty of a no-obligation cash offer is that it allows homeowners to explore multiple offers. They can receive bids from various buyers, compare them, and choose the one that aligns best with their goals and expectations.

-

A Tool for Negotiation

Having a no-obligation cash offer in hand can be a powerful negotiation tool. Homeowners can use it as a benchmark when discussing terms with other potential buyers or even real estate agents. It provides a tangible figure to work with and can be a negotiation starting point.

-

Reducing Pressure

One of the main advantages of a no-obligation offer is the reduced pressure on the homeowner. They can take their time to consider the proposal, consult with family or professionals, and make an informed decision without feeling rushed.

-

Transparency and Trust

A cash buyer willing to provide a no-obligation offer often signals transparency and trustworthiness. It shows that the buyer is confident in their offer and respects the homeowner’s right to make the best decision for their situation.

-

Points to Consider

While the concept is beneficial, homeowners should be cautious. It’s essential to read any documents associated with the offer carefully. Ensure that “no-obligation” doesn’t come with hidden clauses or conditions that could be unfavorable.

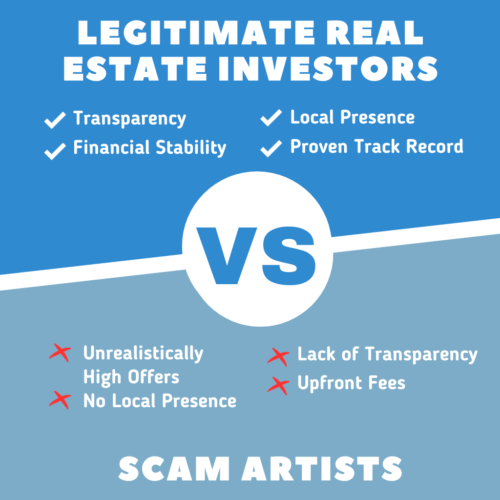

The Role of the Investor in the 'Buy Homes' Industry

Their presence can help landlords who want to sell their homes quickly, but like any other industry, some people are genuinely helpful, and others are not.

Let's talk about the investor's role and how to differentiate between honest legitimate cash buyer and a dishonest one.

-

The Legitimate Investor

A genuine real estate investor typically will buy your house with the intent of either renting it out, renovating and reselling it for a profit, or holding onto it for long-term appreciation.

Their approach is methodical, backed by market research, and often contributes positively to neighborhoods by improving properties and increasing overall values.

Key Characteristics

- Transparency: They are upfront about their intentions with the property and how they derive their offer prices.

- Financial Stability: Genuine investors have the financial backing or resources to close deals without resorting to dubious tactics.

- Local Presence: Many legitimate investors have a local presence, understanding the nuances of the communities in which they invest.

- Reputation: They often come recommended, with a track record of successful transactions, fair cash offers, and positive seller feedback.

The Scam Artist

On the flip side, the industry unfortunately sees its share of scam artists posing as investors. These individuals or entities might use high-pressure tactics, make unrealistic promises, or employ bait-and-switch strategies to prey on unsuspecting homeowners.

-

- Too Good to Be True Offers: If an offer seems unrealistically high without a proper property evaluation, it’s a red flag.

- Lack of Transparency: Scammers often need to give straight answers, be evasive about their intentions, or provide consistent information.

- No Local Presence: Be wary of “investors” who don’t have a local office or any local market knowledge.

- Upfront Fees: Any demands for upfront payments, whether for “processing” or “administrative” reasons, should be viewed with suspicion.

Warning Signs

The Investor’s Contribution to the Industry

Legitimate investors bring several benefits to the real estate industry.

- Revitalizing Communities: By renovating distressed properties, they can uplift entire neighborhoods, increasing property values and community pride.

- Providing Liquidity: Investors offer homeowners a quick way to convert their homes into cash, which can be especially beneficial in urgent situations.

- Filling Market Gaps: In areas where traditional sales might be slower, investors can provide a consistent demand.

-

Conclusion

These days, the real estate market moves quickly, and “Buy Houses for Cash” ads are everywhere. There’s no denying the allure of a quick sale, but you need to be very careful. Not only is your home an asset, but it also holds memories, investments, and years of hard work.

Cash offers are tempting, but what you really want is a deal that protects your interests and takes into account how much your home is worth. Remember that in real estate, the best way to avoid falling for scams and get the real benefits of real cash deals is to be well informed.