So you’re looking to sell your house…but you want to know what happens after the sale. There are two certainties in life, death and taxes. When you sell a house in Florida, there are taxes you’ll need to pay. However, there are ways to avoid capital gains tax when you sell a house in Florida. If you want to maximize your profit and avoid tax liabilities, then you’ll need to keep on reading. Throughout this guide, you’ll learn about the taxes you might face when selling a house in Florida and strategies to minimize or avoid capital gains tax.

What Taxes Do You Pay When You Sell a House in Florida

There are a few types of taxes that are typical with a Florida home sale.

Capital Gains Tax

Capital gains tax is levied on the profit from the sale of an asset, such as real estate. If you sell your home for more than what you paid for it, the profit (capital gain) is subject to tax. The rate depends on how long you’ve owned the property:

- Short-term capital gains: These are taxed at your ordinary income tax rate if you’ve owned the property for one year or less. For example, if you fall into the 22% tax bracket, your short-term capital gain will be taxed at 22%.

- Long-term capital gains: If you’ve owned the property for more than a year, the tax rate is typically lower, ranging from 0% to 20% based on your income level. For most taxpayers, the rate is 15%, but it can be 0% for those in the lower tax brackets and 20% for high-income earners.

Documentary Stamp Tax

In Florida, the documentary stamp tax is imposed on documents that transfer interest in real property, such as deeds. The tax rate is $0.70 per $100 of the property value. For example, if your property sells for $300,000, the documentary stamp tax would be $2,100. This tax must be paid at the time of the transaction and is typically a shared responsibility between the buyer and seller, though it can be negotiated.

Other Potential Taxes

Although Florida doesn’t have a state income tax, other local taxes or fees may apply depending on the specific location and circumstances of the sale. For instance, some municipalities may impose additional transfer taxes or fees. It’s advisable to consult with a local tax professional to get a complete picture of all possible tax liabilities.

Understanding Capital Gains Taxes When Selling a House in Florida

As always, it’s important to plan ahead even before selling your home. That said, let’s take a look at capital gains tax for home sales in Florida.

Calculating Capital Gains Tax for a Home Sale in Florida

To calculate capital gains, subtract the adjusted basis of your home from the sale price. The adjusted basis includes the original purchase price, plus the cost of improvements, less any depreciation claimed. For example, if you bought your home for $300,000, spent $50,000 on improvements, and sold it for $500,000, your capital gain would be $150,000 ($500,000 – $350,000).

Now, the capital gains tax rate depends on how long you’ve held the home for.

- Short-term capital gains (property held for one year or less) are taxed at ordinary income tax rates, which can be as high as 37% for the highest income brackets.

- Long-term capital gains (property held for more than one year) are taxed at reduced rates, ranging from 0% to 20%, depending on your income level. For instance, if your taxable income is between $47,401 and $518,900 for singles (or $94,050 to $583,750 for married couples), the long-term capital gains rate would be 15%. If you’re single and your taxable income is more than $518,900, then the long-term capital gains tax would be 20%.

| Filing status | 0% | 15% | 20% |

| Single | $0 to $47,025 | $47,026 to $518,900 | $518,901 or more |

| Married filing jointly | $0 to $94,050 | $94,051 to $583,750 | $583,751 or more |

| Married filing separately | $0 to $47,025 | $47,026 to $291,850 | $291,851 or more |

| Head of household | $0 to $63,000 | $63,001 to $551,350 | $551,351 or more |

Primary Residence Exclusion

One of the most beneficial exemptions is the primary residence exclusion. If the home was your primary residence for at least two of the last five years, you could exclude up to $250,000 of the gain if you are single or $500,000 if you are married and filing jointly. This exclusion can significantly reduce or even eliminate your capital gains tax liability. For instance, if you and your spouse sold your primary residence and made a $300,000 profit, the entire amount could be excluded from capital gains tax under this exemption.

What is Documentary Stamp Tax?

The documentary stamp tax in Florida is a tax on documents that transfer an interest in real property. The rate is generally $0.70 per $100 of the property value, although the rate can be different in certain counties. For instance, Miami-Dade County charges a higher rate on residential properties other than single-family homes. This tax is required at the time of the transfer and must be paid to avoid penalties.

When and How to Pay Documentary Stamp Tax in Florida

The documentary stamp tax is typically paid at closing, and the responsibility for payment is usually negotiated between the buyer and seller. It’s essential to ensure it is paid on time to avoid any potential penalties or legal issues. The payment process involves submitting the appropriate forms and payments to the Florida Department of Revenue or through a title company handling the transaction. Ensuring the correct amount is paid and documented properly can prevent future complications.

What is Property Tax Proration?

Property tax proration involves dividing property taxes between the buyer and the seller based on the number of days each party owns the property during the tax year. This ensures that each party pays their fair share of the annual property taxes. For example, if you sell your house halfway through the year, you would only be responsible for the property taxes up to the date of the sale, while the buyer would cover the remaining portion of the year.

Calculation Methods

Property tax proration can be calculated using either the 365-day method or the 360-day method. The 365-day method divides the annual property tax bill by 365 days, while the 360-day method assumes 30 days for each month. Here’s an example using the 365-day method:

- Annual property tax bill: $4,000

- Closing date: June 30 (180 days into the year)

- Seller’s responsibility: $4,000 / 365 * 180 = $1,972.60

- Buyer’s responsibility: $4,000 – $1,972.60 = $2,027.40

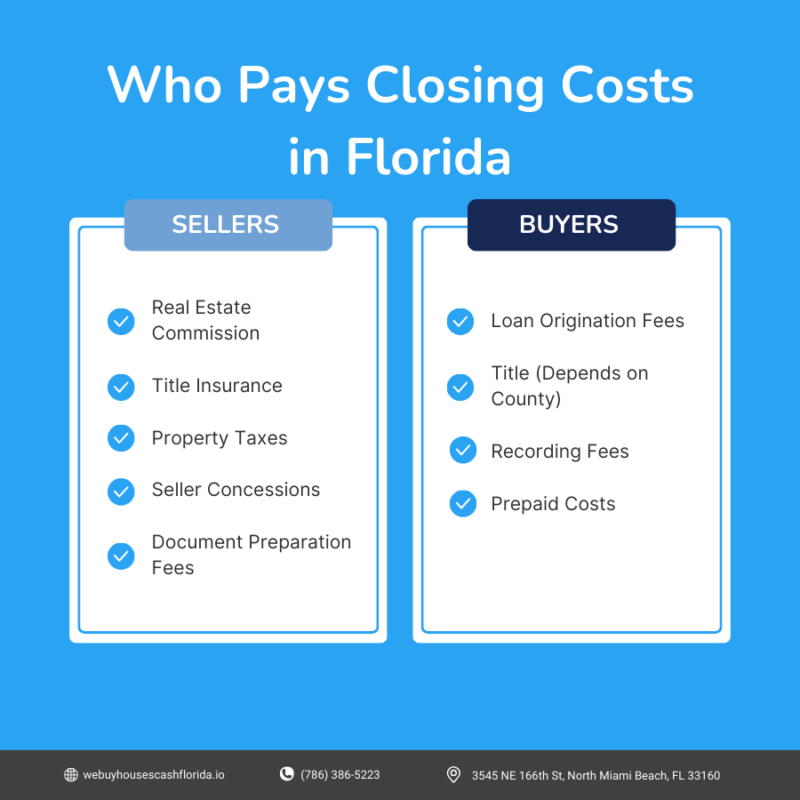

Transfer Taxes and Fees When Selling a Home in Florida

Some Florida municipalities may impose additional transfer taxes on real estate transactions. These taxes are typically calculated as a percentage of the property’s sale price and are due at closing. It’s essential to be aware of any local transfer taxes that may apply to your transaction to budget appropriately.

Selling a house can also involve various other fees, such as:

- Title insurance: Protects the buyer and lender from any disputes over property ownership.

- Attorney fees: Covers legal advice and document preparation.

- Real estate agent commissions: Typically 5-6% of the sale price, split between the buyer’s and seller’s agents.

- Escrow fees: Fees for the escrow company to handle the closing process.

These fees can add up, so it’s important to factor them into your overall selling costs.

Pro-Tip for Avoiding Taxes When Selling a House in Florida: Utilize a 1031 Exchange

Savvy real estate investors will use the 1031 exchange rule to their favor… and you can use it too.

What is a 1031 Exchange?

A 1031 exchange, named after Section 1031 of the Internal Revenue Code, allows you to defer paying capital gains tax on an investment property when it is sold, provided another “like-kind” property is purchased with the profit gained by the sale. This can be a beneficial strategy for real estate investors looking to reinvest in another property without the immediate tax burden.

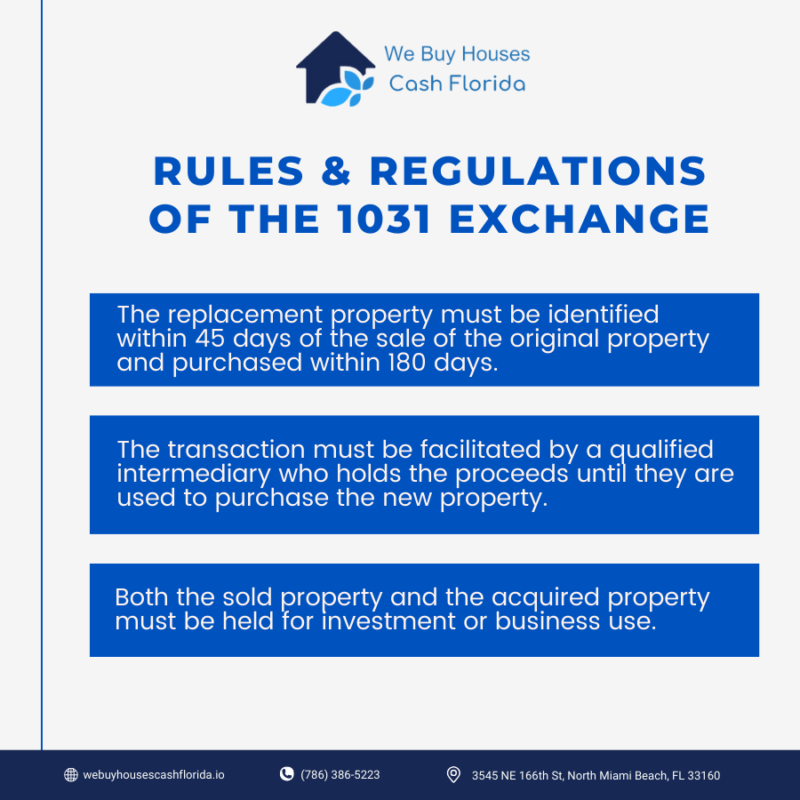

Rules and Regulations of the 1031 Exchange

To qualify for a 1031 exchange, the new property must be of “like-kind,” which generally means it must be of the same nature or character, even if it differs in grade or quality. Here are key rules:

- Timeline: The replacement property must be identified within 45 days of the sale of the original property and purchased within 180 days.

- Qualified Intermediary: The transaction must be facilitated by a qualified intermediary who holds the proceeds until they are used to purchase the new property.

- Property Use: Both the sold property and the acquired property must be held for investment or business use.

Potential Pitfalls

Missteps in following the strict timelines and regulations can lead to disqualification of the 1031 exchange, making the deferred gains immediately taxable. Additionally, the new property should ideally be of equal or greater value to defer the entire gain.

How to Avoid Capital Gains Taxes When Selling a House in Florida

Tax-Loss Harvesting

Tax-loss harvesting involves selling securities at a loss to offset a capital gains tax liability. This can apply to real estate if you have other investments that have lost value. The losses from these investments can be used to offset the gains from the sale of your property, thereby reducing your overall taxable income.

Limitations and Rules

The IRS limits the amount of capital loss that can be used to offset ordinary income to $3,000 per year ($1,500 if married filing separately). Losses beyond this limit can be carried forward to future years. It’s important to note that losses on personal-use property, such as your primary residence, are not deductible.

Use Holding Periods to Your Advantage

To benefit from the lower long-term capital gains rates, it’s advisable to hold onto your property for more than one year. Long-term capital gains rates are significantly lower than short-term rates, which are taxed as ordinary income. For instance, while short-term gains can be taxed up to 37%, long-term gains are taxed at 0%, 15%, or 20%, depending on your income bracket.

Florida Tax Rules

Florida is known for its favorable tax environment, primarily due to the absence of a state income tax. This can be a significant advantage for residents and investors alike, as it reduces the overall tax burden compared to states with high-income taxes.

Despite the lack of a state income tax, certain municipalities within Florida may impose additional taxes or fees on property transactions. For instance, some areas might have local transfer taxes or special assessments that could affect your sale. Understanding these local variations is essential for accurate tax planning.

As always, it would be wise to consult with a tax professional to find out what taxes you may owe when selling a home in Florida.

Final Thoughts on the Taxes You Pay When Selling a Home in Florida

Understanding and managing the taxes associated with selling a house in Florida is essential for protecting your profits and minimizing liabilities. By leveraging strategies such as the primary residence exclusion, making home improvements, and considering a 1031 exchange, you can significantly reduce or even avoid capital gains tax. Always consult with a tax professional to tailor these strategies to your specific situation and ensure compliance with current laws.

If you’re looking to sell your house quickly and want to avoid the complexities of capital gains tax, consider reaching out to We Buy Houses Cash Florida IO. We offer fast, fair cash offers and a streamlined process that can close in as little as 10 to 15 days. Contact us today to learn more and get started on your hassle-free home sale.

FAQs

Do I have to pay taxes on gains from selling my house in Florida?

Yes, you may have to pay federal taxes on the gains from selling your house in Florida. This is known as capital gains tax. However, if the property was your primary residence for at least two of the last five years, you might qualify for the primary residence exclusion, which allows you to exclude up to $250,000 of the gain if you are single, or $500,000 if you are married and filing jointly. This can significantly reduce or eliminate your capital gains tax liability.

Do I pay taxes to the IRS when I sell my house?

Yes, if you make a profit from selling your house, you may owe capital gains tax to the IRS. The amount of tax you owe depends on how long you owned the property and how much profit you made. Short-term capital gains (property held for one year or less) are taxed at your ordinary income tax rate, while long-term capital gains (property held for more than one year) are taxed at reduced rates, ranging from 0% to 20%, depending on your income level.

Does buyer or seller pay sales tax in Florida?

In Florida, there is no sales tax on the sale of real estate. However, there is a documentary stamp tax, which is a tax on documents that transfer an interest in real property. The rate is generally $0.70 per $100 of the property value. This tax is typically paid at closing, and the responsibility for payment is usually negotiated between the buyer and the seller.

Do sellers pay property taxes at closing in Florida?

Yes, property taxes in Florida are prorated between the buyer and the seller at closing. This means that the seller is responsible for the property taxes up to the date of the sale, and the buyer is responsible for the property taxes for the remainder of the year. This ensures that each party pays their fair share of the annual property taxes based on their period of ownership during the tax year.

Do I have to buy another house to avoid capital gains?

No, you do not have to buy another house to avoid capital gains tax. The primary residence exclusion allows you to exclude up to $250,000 (single) or $500,000 (married) of capital gains from the sale of your home if it was your primary residence for at least two of the last five years, regardless of whether you buy another house. However, if you are selling an investment property, you might consider a 1031 exchange, which allows you to defer paying capital gains tax by reinvesting the proceeds into a like-kind property.