If a house is in probate, can it be sold?” is a question many heirs grapple with after the passing of a loved one. The real estate market is complicated enough without adding the complexity of selling a home in probate. Even the most seasoned homeowner may feel overwhelmed by this procedure, which is often misunderstood and plagued with legal huddles. With this manual you’ll learn the ins and outs of selling a house while in probate to ensure your transaction goes off without a hitch during this potentially trying time.

Key Takeaways

- Probate sales involve unique legal procedures.

- Heirs’ emotions can influence probate property decisions.

- Expert real estate agents simplify probate transactions.

- Probate properties offer distinct buying opportunities.

- Understanding probate can unlock real estate potential.

About the Probate Process

When a loved one passes away, their estate often enters a legal process called probate. This procedure ensures that the deceased’s assets are distributed correctly and that any debts are settled.

Definition and Purpose of Probate

Probate is the legal process that takes place after someone’s death to validate their will, settle their debts, and distribute their assets. If the deceased left a will, the probate court would determine its authenticity. If no will exists, the court will decide how to distribute the assets based on state laws. The primary purpose of probate is to ensure that the deceased’s wishes are honored and that all financial obligations are met.

Real estate properties, such as homes, are often the most significant assets in an estate. When these properties go through probate, it’s crucial to understand the steps involved, especially if the heirs or beneficiaries want to sell the house.

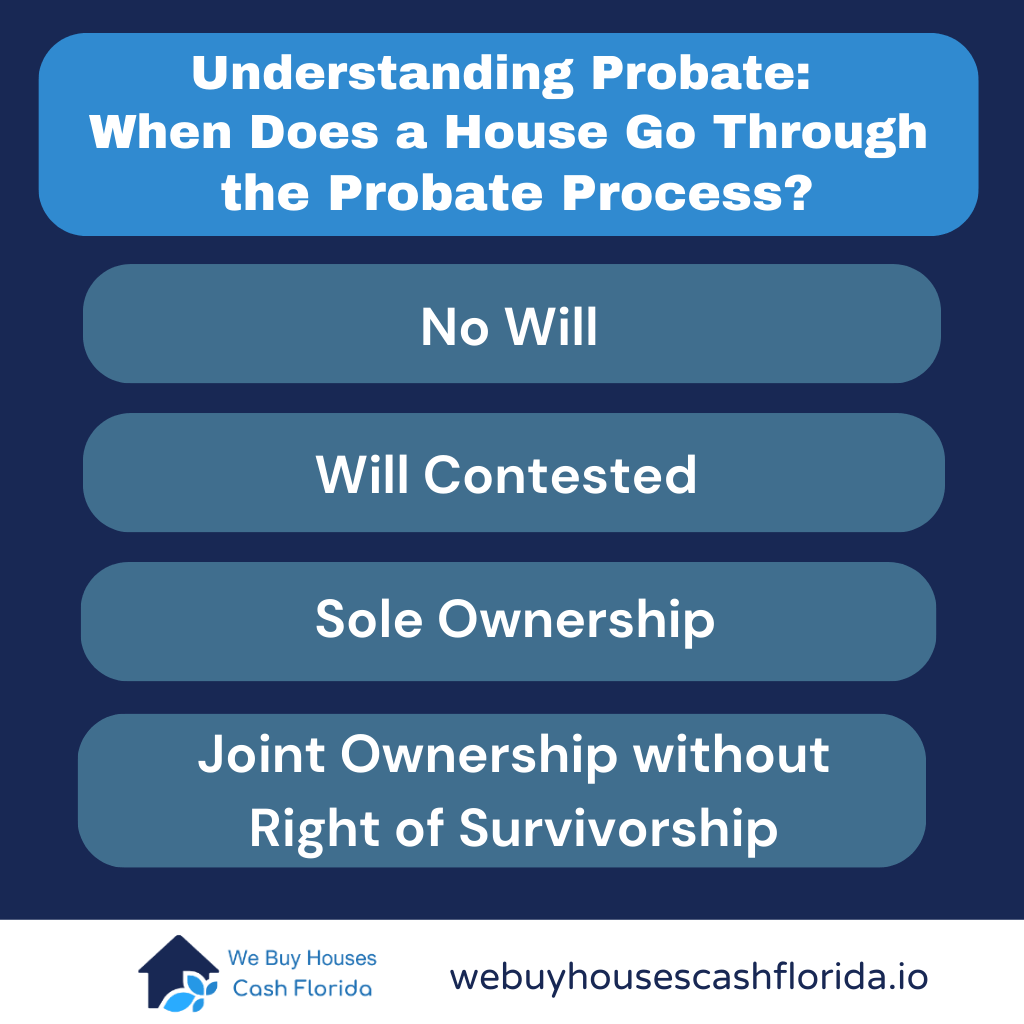

Situations When a House Might Go Through Probate

-

No Will

If a property owner dies without a will (intestate), the estate will likely go through the probate process. The court will then determine how to distribute the assets, including real estate properties.

-

Will Exists but is Contested

Sometimes, even if there’s a will, disputes arise among heirs or beneficiaries. In such cases, the probate court must intervene to resolve the disagreements and ensure fair distribution.

-

Sole Ownership

If the deceased were the sole property owner, it would typically need to go through probate before it can be sold or transferred.

-

Joint Ownership without Right of Survivorship

Properties owned jointly but without the right of survivorship (like Tenants in Common) will also go through probate for the deceased’s share.

When real estate is at stake, it can be challenging to navigate the probate process. The subject of whether or not an executor can sell a home during probate is a common one.

Let’s Explore this procedure.

The Authority and Responsibilities of the Executor

When a person drafts a will, they typically appoint an executor to manage their estate upon their passing. This individual, sometimes called the estate executor or the estate’s representative, holds a significant responsibility. Their primary role is to ensure that the deceased’s wishes, as outlined in the will, are carried out to the letter.

The executor’s authority is derived from the will and the probate court. Once the will is validated, the court grants the executor a legal document known as “letters testamentary,” which empowers them to act on behalf of the estate. This includes the authority to sell estate property, such as a house, if necessary.

However, the executor must always act in the best interest of the estate and its beneficiaries. This means they should:

-

- Assess the value of the probate property.

- Determine if selling the property is financially prudent, especially after considering estate debts and potential tax implications.

- Consult with heirs or beneficiaries if they want to sell the house or retain it.

While the executor has the power to sell a home during probate, they must follow certain procedures:

- Court Approval: In many jurisdictions, the probate court must approve the sale of the property, especially if it’s explicitly mentioned in the will or if beneficiaries contest the sale.

- Property Appraisal: Before listing the property, it’s essential to get an accurate valuation. This might involve hiring a professional appraiser familiar with probate real estate.

- Transparent Sale Process: The sale should be open and transparent, ensuring that the estate gets the best possible price. This might involve public auctions or listing with a real estate agent experienced in probate sales.

While the executor has the power to sell a home during probate, they must follow certain procedures:

- Court Approval: In many jurisdictions, the probate court must approve the sale of the property, especially if it’s explicitly mentioned in the will or if beneficiaries contest the sale.

- Property Appraisal: Before listing the property, it’s essential to get an accurate valuation. This might involve hiring a professional appraiser familiar with probate real estate.

- Transparent Sale Process: The sale should be open and transparent, ensuring that the estate gets the best possible price. This might involve public auctions or listing with a real estate agent experienced in probate sales.

While both processes aim to sell the property, there are distinct differences between an executor-led sale and a traditional one:

- Legal Oversight: Every step of the executor sale is overseen by the probate court, ensuring that the interests of all parties are protected.

- Time-Frame: Due to the legal intricacies, selling a house through probate might take longer than a conventional sale.

- Financial Implications: Proceeds from the sale are first used to settle any outstanding debts of the estate before being distributed to heirs. This differs from a regular sale where proceeds typically go to the property owner.

How to Buy Probate Real Estate

Buying a home through probate can provide many advantages, including the chance to save money and acquire a piece of architectural or historical value. Probate property acquisitions, though share many general principles and concepts to other property purchases, are different in the process it takes to complete.

Let’s look at what it takes to buy probate property, what you can gain and lose, and how the process differs from the norm.

Steps to Buy Probate Property

-

Step 1 Research Listings

Start by searching for probate property listings in local newspapers, real estate websites, or through a real estate agent experienced in probate sales.

-

Step 2 Attend Probate Court Hearings

Some jurisdictions require probate property sales to be announced in court. Attending these hearings can provide insights into available properties and the starting bid amounts.

-

Step 3 Inspect the Property

Just like any other real estate purchase, inspect the probate property to assess its condition, required repairs, and potential value.

-

Step 4 Submit an Offer

Once you’ve identified a property, submit an offer. Remember, the probate court must approve all offers, so ensure your bid is competitive.

-

Step 5 Participate in Auctions

If multiple parties are interested, the property might go to auction. Be prepared to bid on the property against other potential buyers.

-

Step 6 Complete the Legal Paperwork

Once your offer is accepted and approved by the court, complete all necessary legal documentation to finalize the purchase.

Benefits and Risks of Buying Probate Real Estate

Benefits

- Potential for Lower Prices: Probate properties might be priced lower than market value, especially if the estate needs to settle debts quickly.

- Unique Properties: Probate sales can include homes with unique architectural or historical significance not commonly found in the regular market.

- Less Competition: Given the complexities of probate sales, fewer buyers might be competing, potentially giving you an edge.

Risks

- Property Condition: As probate properties might have been uninhabited for a while, they could require significant repairs or renovations.

- Lengthy Process: The involvement of the probate court can prolong the buying process, leading to delays.

- Potential Overbidding: In auction scenarios, there’s a risk of overbidding and paying more than the property’s actual worth.

The Difference Between Buying Probate and Traditional Property Purchases

-

Legal Oversight

Probate sales are overseen by the court, ensuring transparency and adding layers of bureaucracy absent in traditional sales.

-

Approval Requirements

Offers on probate properties require court approval, which isn’t the case in regular real estate transactions.

-

Uncertain Timeframes

While traditional property purchases have relatively predictable timelines, probate sales can be delayed due to court schedules, disputes among heirs, or other legal complexities.

-

Emotional Dynamics

Sellers in a probate sale often deal with losing a loved one, which can add an emotional dimension not typically present in standard sales.

The death of a loved one is an emotionally challenging time, and when a property is involved, it adds another layer of complexity. Heirs or beneficiaries play a pivotal role in the probate sale process, as they often stand to inherit the deceased’s assets. Their decisions, rights, and responsibilities can significantly influence the outcome of a probate property sale.

Rights and Responsibilities of Heirs

-

Inheritance Rights

Heirs have a legal right to inherit assets, including real estate, as outlined in the deceased’s will. If no will exists, inheritance is determined by state laws, which typically favor close relatives like spouses, children, or parents.

-

Decision-making

Heirs have a say in the management and disposition of the estate property. While the executor or administrator manages the estate, they must consider the wishes and best interests of the heirs.

-

Obligation to Debts

Before any distribution, the debts of the estate must be settled. Heirs ensure that any outstanding debts, taxes, or other obligations are paid from the estate’s assets.

-

Right to Information

Heirs have the right to be informed about the estate’s status, including any decisions regarding the sale of probate real estate.

-

Financial Needs

An heir might want to sell the house to liquidate their inheritance, especially if they have pressing financial needs or if the estate has significant debts.

-

Emotional Reasons

For some, retaining the family home might have sentimental value, making them more inclined to keep the property.

-

Investment Considerations

If the probate property is in a prime location or has potential for appreciation, heirs might see it as a valuable investment and choose to retain it.

-

Tax Implications

Selling a house in probate might have tax consequences, such as capital gains tax. Heirs might weigh these implications when deciding to sell or retain.

Conflicts among heirs are not uncommon, especially when significant assets like real estate are involved. Here’s how such disputes can be addressed:

-

Mediation

A neutral third party can help heirs discuss their concerns and reach a consensus. Mediation can be a less adversarial and more cost-effective solution than litigation.

-

Legal Intervention

If heirs cannot agree, they might seek a court’s intervention. The probate court may decide based on the estate’s best interests and the deceased’s likely wishes.

-

Buyouts

If one heir wants to retain the property while others wish to sell, a buyout is an option. The interested heir can purchase the other heirs’ shares, allowing them to keep the property.

-

Engaging a Probate Attorney

An experienced probate attorney can provide legal advice, helping heirs understand their rights and options. They can also guide heirs through the resolution process.

While the probate process can seem daunting, especially when it involves selling a cherished family home, there are distinct advantages to selling a home in probate. From financial gains to streamlining the estate’s affairs, let’s explore the benefits of such a sale.

Potential Financial Benefits

Liquidity for the Estate

Selling a house in probate can provide the estate with immediate liquidity. This is especially beneficial if the majority of the estate’s value is tied up in the property, leaving little cash for other obligations.

Maximizing Asset Value

With the right marketing strategy and an experienced probate real estate agent, the property can fetch a competitive market price. This ensures that the heirs or beneficiaries receive the maximum value from their inheritance.

Tax Advantages

Due to the “stepped-up basis” tax provision, heirs might benefit from reduced capital gains taxes when selling a probate property. Essentially, the property’s tax basis is adjusted to its fair market value at the time of the owner’s death, potentially reducing the taxable gain when sold.

Simplifying the Estate Settlement Process

Easier Distribution

Liquid assets are simpler to divide among multiple heirs or beneficiaries. By converting the property into cash, it can be more straightforward to distribute the estate’s assets as per the deceased’s wishes or state laws.

Reducing Maintenance Costs

Maintaining a vacant property can be costly, from property taxes to upkeep expenses. Selling the home eliminates these ongoing costs, ensuring that the estate’s value isn’t eroded by such expenses.

Avoiding Future Complications

Real estate markets can be unpredictable. By selling the property during the probate process, the estate avoids potential future market downturns, ensuring that the asset’s value is locked in.

Meeting Legal Obligations, Such as Paying Off Debts

Settling Debts

The estate is legally obligated to settle any outstanding debts before assets are distributed to heirs. The sale of a probate home can provide the necessary funds to clear these debts, ensuring that the estate doesn’t face legal challenges from creditors.

Covering Probate Costs

The probate process itself can be costly, with court fees, attorney charges, and other related expenses. The proceeds from the sale can help cover these costs, ensuring that the estate is settled without financial strain.

Fulfilling Legal Requirements

In some cases, the will might explicitly state the need to sell the property, or the probate court may deem it necessary for various reasons. Selling the home ensures that the estate complies with such legal mandates.

It’s hard to sell a house that is in probate. As we’ve already discussed, there are some benefits, but the process also has some problems that can make it more complex than a normal real estate sale.

Let us talk about the difficulties of selling probate property, ranging from figuring out complicated law issues to dealing with people’s feelings and the state of the property.

Legal Complexities and Court Interventions

-

Navigating Legal Protocols

The probate process is governed by a set of specific laws and regulations that vary by jurisdiction. Ensuring compliance with these rules, from obtaining the necessary approvals to ensuring transparent bidding processes, can be daunting.

-

Court Approvals

Unlike regular real estate transactions, selling a probate property often requires explicit approval from the probate court. This can prolong the sale process and introduce uncertainties, especially if there are disputes or challenges.

-

Documentation and Paperwork

The amount of paperwork involved in a probate sale can be overwhelming. From validating the will to obtaining letters of administration and ensuring all beneficiaries are on board, the documentation can be extensive.

Emotional Challenges for Family Members

-

Grieving Process

Selling a loved one’s home can be emotionally taxing, especially when family members are still grieving. The home might hold sentimental value, making the decision to sell even more challenging.

-

Disagreements Among Heirs

Different family members might have varying opinions on whether to sell the house or retain it. These disagreements can lead to delays and even legal disputes.

-

Emotional Attachment to Property

For some heirs, the idea of strangers living in their family home can be distressing. This emotional attachment can sometimes cloud judgment and hinder the sale process.

Potential Repairs and Maintenance of the Probate House

-

Property Condition

Often, homes that are part of an estate have been uninhabited for some time. This can lead to maintenance issues, from minor repairs to significant structural problems, which can deter potential buyers.

-

Cost of Repairs

If the estate lacks liquid assets, funding necessary repairs before the sale can be challenging. This might lead to selling the property “as is,” potentially reducing its market value.

-

Aesthetic Outdating

Homes that have been in families for generations might have outdated aesthetics. Modernizing the property to appeal to contemporary buyers can take time and effort.

The sale of probate real estate is a nuanced process, distinct from traditional property transactions. Given the complexities involved, hiring a real estate agent experienced in probate sales can be invaluable.

Let’s explore the reasons why enlisting the services of such an agent can make a significant difference in the outcome of a probate sale.

Expertise in Navigating the Probate Real Estate Market

-

Understanding of Probate Procedures

A real estate agent with expertise in probate sales is well-versed in the specific procedures and legalities of the probate market. This ensures that every step, from listing to closing, adheres to the necessary protocols.

-

Market Knowledge

These agents have a pulse on the probate real estate market, understanding its trends, challenges, and opportunities. This knowledge can be instrumental in pricing the property right and targeting the appropriate buyer demographic.

-

Tailored Marketing Strategies

Selling a probate property requires a different marketing approach. Experienced agents can craft strategies that highlight the property’s unique value propositions, attracting potential buyers interested in probate sales.

Assistance in Legal Documentation and Court Proceedings

-

Streamlined Paperwork

The paperwork involved in a probate sale can be extensive. A knowledgeable agent can help streamline this process, ensuring that all documents are correctly filled out and submitted on time.

-

Liaison with Probate Court

Given that many probate sales require court approvals, having an agent familiar with court proceedings can be beneficial. They can act as a liaison, facilitating communication and ensuring that court requirements are met.

-

Collaboration with Probate Attorneys

A real estate agent experienced in probate sales often has a network of probate attorneys they collaborate with. This can be invaluable in ensuring that the legal aspects of the sale are seamlessly handled.

Negotiation Skills Tailored to Probate Property Sales

-

Understanding Buyer Concerns

Buyers in the probate market often have specific concerns, from property conditions to legal implications. An experienced agent can address these concerns effectively during negotiations.

-

Maximizing Sale Price

Given the unique dynamics of the probate market, negotiation skills tailored to this niche can help in fetching the best price for the property.

-

Handling Multiple Offers

In cases where a probate property attracts multiple bids, an agent’s expertise can be crucial in evaluating offers and ensuring that the estate’s best interests are served.

Quick Probate House Sales

Are you managing a probate property and considering a sale? Our service offers a swift, fair, and stress-free alternative. Here’s how we support you:

-

Fast Cash Offers

Obtain immediate, no-obligation cash offers to provide the estate with quick liquidity.

-

Market-Value Pricing

We evaluate your property to ensure a fair offer that reflects its true market value.

-

Streamlined Process

Avoid the hassle of repairs, showings, and complex negotiations. We handle the details from start to finish.

-

Paperwork Assistance

Our team deals with the extensive paperwork, coordinating with probate attorneys to ensure accuracy and compliance.

-

Compassionate Approach

We recognize the emotional weight of selling a family home and conduct our transactions with sensitivity and respect.

-

Transparent Deals

With no hidden fees or surprises, we prioritize clear and honest communication throughout the sale.

Conclusion

As we’ve journeyed through the intricate landscape of selling a house during probate, it’s clear that this isn’t just any ordinary real estate transaction.

In this article, you’ve gleaned insights into the importance of understanding the process, the potential obstacles you might encounter, and the strategies to optimize the sale.

As you face selling a house in probate, remember the invaluable lessons and strategies from this guide.

Ready to Move Forward?

Selling a probate property does not have to be a prolonged or painful process. With We Buy Houses Cash Florida you can trust that you are partnering with professionals who are committed to providing a smooth and respectful transaction. Contact us today to receive your no-obligation cash offer and take the first step towards resolving your probate sale with ease and certainty.