Should I sell my house to a flipper? It’s a question many homeowners grapple with, especially when faced with the allure of a quick sale and immediate cash. In today’s dynamic real estate landscape, understanding the intricacies of selling to a house flipper can be the key to making informed decisions. Dive in as we unravel the pros, cons, and everything in between, ensuring you’re equipped with the knowledge to navigate this unique real estate avenue.

Key Takeaways

- House flipping offers homeowners a quick sale option.

- Immediate cash needs can drive sales to flippers.

- Selling to flippers may yield a lower price but faster deals.

- The flipper transaction process is straightforward and efficient.

- Trust and communication are vital when selling to flippers.

Understanding A House Flipping Investor

House flipping, a term often associated with the real estate investing world, is a strategy that has gained significant attention over the years. But what exactly does it mean to flip a house, and who are the key players in this industry?

At its core, a house flipper is an individual or entity that buys properties with the primary intention of selling them for a profit. The words “house flipper” often conjure images of savvy investors diving into the real estate market, seeking homes that can be purchased at a lower cost, often because they need to sell or are in distress.

After acquiring a property, the house flipper may then undertake necessary renovations and repairs to enhance the value of your home. The goal is to increase the property’s market appeal and, consequently, its market value.

Situations like an inherited property, financial distress, or the house needs a lot of immediate attention can push homeowners looking to sell into the arms of flippers.

There are various types of flippers in the industry.

Mom-and-Pop

Flippers might be individuals or couples who flip homes as a side gig or hobby.

Full-Time Flippers

Larger entities treat it as a business, often having a team of professionals, including real estate agents, contractors, and home inspectors, to streamline the process.

It’s also essential to differentiate between a house flipper and a real estate agent or brokerage like Coldwell Banker. While a real estate agent assists clients in buying or selling a home, often listing the property on the MLS and aiming to get the best price, a house flipper is both the buyer and the seller, aiming to make a profit from the sale price.

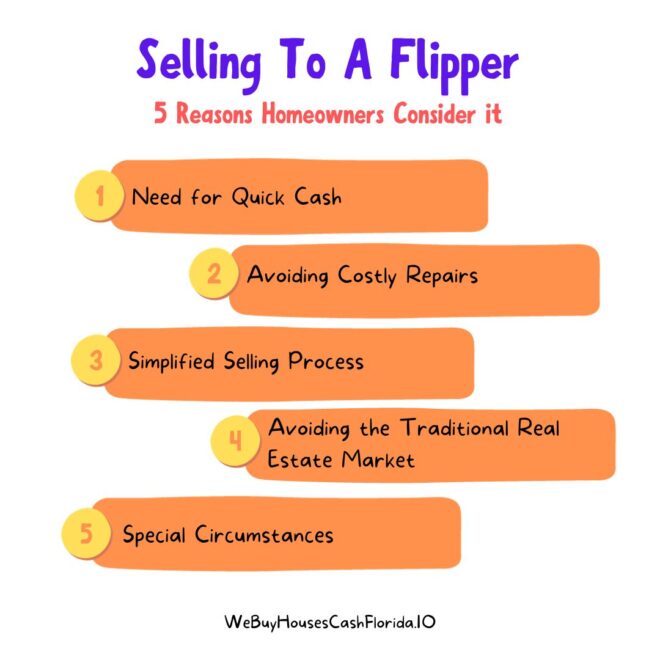

Reasons Homeowners Consider Selling to a Flipper

Need for Quick Cash

One of the most compelling reasons homeowners sell their homes fast to flippers is the immediate need for liquidity. Financial hardships, such as mounting debts, medical emergencies, or sudden unemployment, can push homeowners to seek out cash buyers like flippers.

Unlike traditional sales, which can take weeks or even months, flippers often pay cash for properties and can close deals within 24 hours or a few days.

Avoiding Costly Repairs

Homes that are older or have been neglected often require significant repairs and upgrades. For homeowners who cannot afford these renovations or simply don’t want to deal with the hassle, selling to a flipper who buys homes as-is becomes an attractive option.

The words “house flipper” are synonymous with taking on projects that others might shy away from, especially if the house needs a lot of work.

Simplified Selling Process

The traditional route of listing your home with a real estate agent, preparing for countless viewings, and navigating negotiations can be daunting for many. Flippers offer a more streamlined approach. There’s no need to stage the home, conduct open houses, or wait for homebuyer mortgage approvals.

The process is straightforward: receive an offer, evaluate it, and if it aligns with your expectations, close the deal.

Avoiding the Traditional Real Estate Market

Sometimes, the real estate market might not be favorable for sellers. Prices might be depressed, or there could be an oversupply of properties. In such scenarios, homeowners who need to sell your home might find it challenging to get a fair market price.

Flippers, with their intent to renovate and sell at a later date, might still offer competitive prices even in a sluggish market.

Special Circumstances

There are instances where homeowners inherit properties they have no intention of keeping. In cases of inherited property, the new owners might not have the emotional attachment or might live out of state, making it cumbersome to manage the sale. Flippers provide a quick solution, allowing these homeowners to liquidate the asset without much fuss.

In essence, while the idea of selling to a house flipper might initially seem unconventional, it’s a choice driven by genuine needs and the allure of convenience. For many, it’s a practical solution that offers speed, simplicity, and relief from potential challenges of the traditional selling process.

Pros and Cons of A Sell to a House Flipper

Choosing to sell your home to a house flipper comes with its set of advantages and disadvantages. Like any significant decision, it’s crucial to weigh the pros and cons to determine if this route aligns with your goals and circumstances. Let’s explore the benefits and potential drawbacks of selling to a flipper:

Pros

Speedy Transaction

One of the most significant advantages of selling to a flipper is the speed of the transaction. Flippers often buy houses with the intent to renovate and resell, so they’re motivated to close deals quickly. For homeowners who need to sell their home quickly, this can be a godsend, especially when compared to the potential wait times of the traditional real estate market.

No Need for Repairs

Flippers are accustomed to buying homes as-is. Whether your house needs a lot of work or just a few touch-ups, you won’t have to spend time or money on repairs. This is especially beneficial for homeowners who might not have the funds or desire to make repairs before selling.

Simplified Process

Selling to a flipper eliminates many of the steps involved in a traditional sale. There’s no need for staging, open houses, or dealing with multiple potential homebuyers. The process is straightforward, often culminating in a cash offer for your home.

Avoiding Real Estate Agent Fees

By selling directly to a flipper, homeowners can bypass the traditional route of hiring a real estate agent and, as a result, avoid paying agent commissions. This can result in significant savings, especially if the home’s value is high.

Cons

Potentially Lower Selling Price

One of the primary concerns homeowners have is that flippers might offer less than what the home could fetch on the open market. Since flippers aim to make a profit after covering renovation costs and other expenses, their offers might be below the market value of the property.

Lack of Competitive Bidding

In a hot real estate market, homes can attract multiple offers, driving up the sale price. When selling to a flipper, homeowners might miss out on this competitive bidding process.

Emotional Factor

For many, their home holds sentimental value. Knowing that a flipper might make significant changes or renovations can be emotionally challenging for some homeowners.

Less Negotiation Room

Flippers operate with a business model in mind. While there’s always some room for negotiation, they might not be as flexible as a traditional home buyer who’s emotionally invested in the property.

The Process To Sell Your House To A Flipper

Navigating the process of selling your home to a house flipper can be a unique experience, distinct from the traditional real estate route. The steps are streamlined, often leading to a quicker sale, but it’s essential to understand each phase to ensure a smooth transaction. Here’s a breakdown of the selling process when working with a flipper:

Initial Contact

The process typically begins with the homeowner reaching out to a flipper or vice versa. Have you seen the yellow “we buy house” signs tape to poles? Most like that is them! Some flippers actively buy houses and might approach homeowners with offers, especially if the property fits their criteria. On the other hand, homeowners can also initiate contact, especially if they need to sell quickly.

Home Evaluation

Once contact is established, the flipper will schedule a visit to evaluate the property. This step is crucial as it allows the flipper to assess the home’s condition, understand the extent of repairs and upgrades needed, and gauge its potential market value post-renovation. It’s during this phase that the homeowner should be transparent about any known issues or concerns related to the property.

Receiving Cash Offers

After the evaluation, the flipper will typically present a cash offer to the homeowner. This offer is based on the home’s current condition, the estimated cost of renovations, and the potential profit margin the flipper aims to achieve.

It’s worth noting that while these offers might be below the market value, they come with the advantage of a quick, hassle-free sale and no additional costs for repairs or agent commissions.

Evaluating the Offer

Homeowners should take their time to evaluate the offer presented. It’s essential to consider the pros and cons, weighing the benefits of a quick sale against potentially receiving a higher price in the traditional market. If the offer feels too low, homeowners can negotiate. Remember, while flippers aim to make a profit, there’s often some wiggle room in their offers.

Closing the Deal

If both parties agree on the price and terms, the next step is to close the deal. Since flippers often pay cash for properties, the closing process can be expedited. There’s no waiting for mortgage approvals or dealing with potential financing hiccups.

The transaction is straightforward, with the homeowner receiving the agreed-upon amount and the flipper taking ownership of the property.

Finalizing Paperwork

Like any real estate transaction, selling to a flipper involves paperwork. This includes the transfer of property title, tax documents, and any other relevant legal documents. It’s advisable for homeowners to have a legal professional review the paperwork to ensure everything is in order.

In summary, selling to a house flipper offers a streamlined and efficient process, especially suited for homeowners looking for a quick sale. While the offers might be below market value, the convenience, speed, and certainty of the transaction can make it an attractive option for many.

Financial Implications

While the allure of a quick sale and immediate cash can be tempting, homeowners should be well-informed about the nuances of such transactions and how market conditions can influence the offers they receive. Here’s a closer look at the financial aspects of selling to a flipper:

Evaluating Offers

When a flipper presents a cash offer, it’s important to remember that this offer is calculated based on several factors. These include…

- The current condition of the home

- The estimated cost of renovations

- The potential resale value

- The profit margin the flipper aims to achieve

Homeowners should compare this offer to the market value of their home and consider how much they might save on repairs, agent commissions, and other selling costs.

Understanding Market Conditions

The real estate market is dynamic, with prices influenced by supply and demand, economic factors, and local conditions. In a hot real estate market, homeowners might receive higher offers from flippers due to increased demand and potential for higher resale values. Conversely, in a sluggish market, offers might be more conservative.

Profit Margins

Flippers are business oriented , aiming to make a profit after covering all expenses. Homeowners should be aware that the offer they receive will account for these profit margins.

While it might be below the potential market value, the convenience and speed of the transaction can offset this difference for many sellers.

Potential Savings

Selling to a flipper can result in significant savings for homeowners. There’s no need to invest in repairs, staging, or marketing the property.

Additionally, by bypassing the traditional route of listing with a real estate agent, homeowners can avoid paying agent commissions, which can amount to a substantial sum.

Future Market Predictions

While it’s challenging to predict future market trends accurately, homeowners should have a basic understanding of where the market might be headed. If predictions indicate a potential downturn, selling to a flipper now might be a wise financial decision. On the other hand, if the market is expected to rise, waiting and selling traditionally might yield a higher return.

Liquidity vs. Maximum Returns

One of the primary financial considerations is the trade-off between immediate liquidity and potential maximum returns. While selling to a flipper provides immediate cash, the offer might be lower than what the homeowner could achieve in the open market. Homeowners should evaluate their financial needs and priorities before making a decision.

Working with a House Flipper To Sell Your Home Fast

Final Thoughts: Should You Sell Your House to a Flipper

Navigating the world of real estate can be a maze, but armed with the right knowledge, you’re set to make decisions that align with your goals. Should I sell my house to a flipper? The answer lies in understanding your priorities, the market, and the unique advantages this route offers.

If you’re craving more insights or ready to take the plunge, don’t wait! Your dream sale might just be a click away. Embark on a journey that could transform your real estate experience!