When buying or selling a home in Florida, one thing that can catch you off guard is closing costs. These expenses can add up, and knowing who’s responsible for what can save you a lot of headaches—and money. With closing costs typically ranging from 2% to 5% of the home’s purchase price, it’s important to get a handle on these before you find yourself at the closing table. Let’s get a detailed look at what closing costs are, how much you can expect to pay, and who pays the closing costs in Florida.

TL;DR: Who Pays Closing Costs in Florida

- Closing costs in Florida typically range from 2% to 5% of the home’s purchase price.

- Buyers usually pay for loan origination fees, appraisal fees, inspection fees, title search and insurance, recording fees, and prepaid costs like homeowner’s insurance and property taxes.

- Sellers generally cover real estate commissions, title insurance, prorated property taxes and HOA fees, seller concessions, and document preparation fees.

- Factors affecting costs include the home’s location, loan type, property type, and negotiated terms.

- To reduce costs, buyers can shop around for lenders, negotiate with sellers, and check for assistance programs. Sellers can compare real estate agents, understand market conditions, and offer to cover some of the buyer’s costs.

What are Closing Costs?

Closing costs are the fees and expenses you pay when you close on a house. They cover various services required to finalize the transaction. Here’s a breakdown of some common closing costs:

- Lender Fees: These include loan origination fees, application fees, and any points you might pay to lower your interest rate.

- Title Insurance: This protects both the buyer and the lender from potential legal issues with the property title.

- Escrow Fees: These fees are paid to the escrow company that handles the closing process.

- Appraisal Fees: These cover the cost of having the property appraised to determine its market value.

- Inspection Fees: Fees for inspecting the property to check for any issues that need to be addressed.

- Recording Fees: Fees for recording the new property deed with the county.

- Attorney Fees: If you use a real estate attorney, their fees will be included here.

How Much are Closing Costs in Florida?

In Florida, for buyers, the closing costs typically range from 2% to 5% of the purchase price. That means for a $400,000 property, you’re looking at $8,000 to $20,000 in closing costs. On the flip side, sellers can pay as much as 9% of closing costs in Florida.

However, there are a number of factors that can affect the closing costs.

- Location: Costs can vary significantly between different cities and counties.

- Loan Type: Different loans have different requirements and associated costs.

- Property Type: Single-family homes, condos, and investment properties may have different closing costs.

- Negotiated Terms: The final amount can be influenced by negotiations between the buyer and seller.

- Documentary Stamp Tax: Florida charges this tax on certain documents, which is included in closing costs. The revenue supports the school district, county, and state. It ensures the buyer can afford the home and covers administrative costs for transferring the title.

- Other Taxes and Fees: These can include attorney fees, title search fees, recording fees, transfer taxes, and mortgage taxes. These additional costs can add up to several thousand dollars.

In Florida, the median sales price is $420,700 and the average closing costs are about $8,500, which is slightly higher than the national average. Keep in mind that this includes both buyer and seller costs combined.

Of course, when you’re in the process of a home sale, it’s important to know who actually foots the bill.

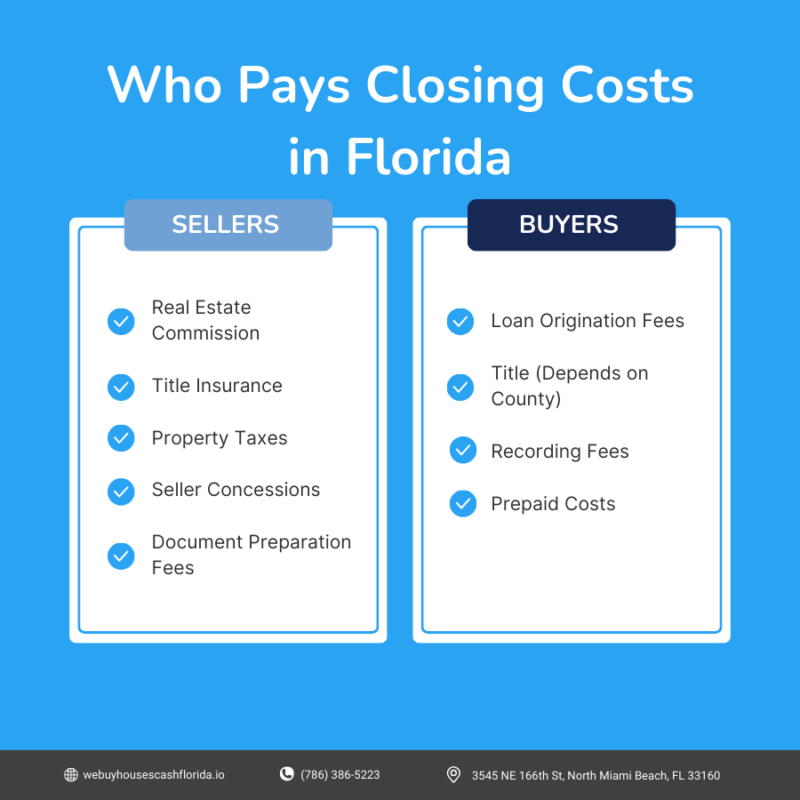

Who Pays Closing Costs in Florida?

In Florida, closing costs are typically split between the buyer and the seller. However, this can vary based on negotiations.

Seller’s Responsibilities for Closing Costs

Sellers in Florida usually cover:

- Real Estate Commission: Typically 5% to 6% of the sale price, split between the seller’s and buyer’s agents.

- Title Insurance: Often paid by the seller in many Florida counties.

- Property Taxes and HOA Fees: Prorated up to the closing date.

- Seller Concessions: Agreed-upon concessions to help cover the buyer’s closing costs.

- Document Preparation Fees: Costs for preparing necessary documents.

Breakdown of Seller’s Closing Costs in Florida

Real Estate Commission

This is typically the largest closing cost for sellers, ranging from 5% to 6% of the home’s sale price, split between the agents. For a $400,000 home, this can be $20,000 to $24,000.

Title Insurance

In many Florida counties, sellers pay for the owner’s title insurance policy, ensuring clear ownership for the buyer. This cost is often around 0.5% to 1% of the sale price.

Property Taxes and HOA Fees

Sellers must pay property taxes and HOA fees prorated up to the closing date. If these taxes have already been paid, the buyer reimburses the seller for the prorated amount.

Seller Concessions

Seller concessions are costs the seller agrees to pay for the buyer, such as covering part of the buyer’s closing costs or offering repair credits. These are often used as negotiation tools.

Document Preparation Fees

Sellers may incur fees for preparing the deed and other legal documents, typically ranging from $100 to $300.

Here’s how the fees would look based on the median home sale price in Florida. Keep in mind, the fees can vary, but typically—sellers are looking at 7% to 9% of the home sale price.

| Closing Cost Item | Typical Cost to Seller |

| Real estate commission (5% to 6% of sale) | $21,035 – $25,242 |

| Transfer taxes or documentary stamp ($0.70 per $100) | $2,944.90 |

| Title insurance (0.5% to 1% of sale) | $2,103.50 – $4,207 |

| Settlement fee | $500-$800 |

| Recording fees | $10 for first page, $8.50 for each additional page |

| Property taxes | Prorated. The average effective property tax rate in Florida is 0.8%. Sellers pay taxes for the period between their last payment and the closing date. |

| Wire transfer fees | $15-$30 |

| Concessions (negotiable) | Varies. Concessions might include paying for specific closing cost items or contributing a negotiated amount toward the buyer’s closing costs. |

| Outstanding amounts (utility bills, HOA fees) | Varies. HOA fees may be prorated. |

| HOA transfer fee | $100 |

| Typical Seller Closing Cost Total | $29,449 – $37,863 |

Buyer’s Responsibilities for Closing Costs

Buyers generally cover:

- Loan Origination Fees: Charged by the lender for processing the loan.

- Appraisal and Inspection Fees: Fees for evaluating the property’s condition and value.

- Title Search and Title Insurance: Protects the lender against title disputes.

- Recording Fees: Fees for recording the deed and mortgage documents.

- Prepaid Costs: Includes homeowner’s insurance, property taxes, and mortgage interest.

Breakdown for Buyer’s Closing Costs

Loan Origination Fees

These fees, charged by the lender for processing the mortgage, typically range from 0.5% to 1% of the loan amount. For a $300,000 loan, this means $1,500 to $3,000.

Appraisal and Inspection Fees

Buyers usually pay for the property appraisal and inspection. An appraisal costs between $300 and $500, while a home inspection ranges from $300 to $400.

Title Search and Title Insurance

Buyers pay for a title search to ensure the property is free from legal claims and for the lender’s title insurance policy. These services typically cost $500 to $1,000.

Recording Fees

Recording fees, paid to the county to officially record the deed and mortgage, range from $200 to $500.

Prepaid Costs

Prepaid costs include homeowner’s insurance, property taxes, and prepaid mortgage interest, often totaling several thousand dollars.

Now, for buyers in Florida, the closing costs are much less than the seller. As mentioned earlier, buyers can expect to pay anywhere between 2% to 5%, but often it’ll hover around 2% to 3% of the purchase price.

How to Reduce Closing Costs

Tips for Sellers to Reduce Closing Costs

- Compare Real Estate Agents: Real estate agents charge different commission rates and offer varying levels of service. By interviewing multiple agents, you can find one that offers a competitive rate while still providing the quality of service you need. Some agents may even be willing to negotiate their commission rates, which can save you thousands of dollars.

- Sell Without a Realtor If you feel confident in handling the sale on your own, consider selling your house without a realtor. This option can save you the 5% to 6% commission fee typically paid to real estate agents. While it requires more effort on your part, such as marketing the property and negotiating with buyers, it can significantly reduce your overall closing costs.

- Be Aware of Local Market Conditions: Understanding the local real estate market can help you set a realistic price for your home. Pricing your home correctly can reduce the time it spends on the market, saving you money on carrying costs like mortgage payments, utilities, and maintenance. A well-priced home is also more likely to attract serious buyers willing to close quickly, reducing the overall closing costs.

- Offer to Pay a Portion of the Buyer’s Closing Costs: Offering to cover some of the buyer’s closing costs can make your home more attractive, especially in a buyer’s market. This strategy can lead to a quicker sale, which can ultimately save you money on ongoing carrying costs. Additionally, it can sometimes result in a higher sale price, offsetting the cost of the concessions.

- Consider Companies That Purchase Houses for Cash: Companies like We Buy Houses Cash Florida offer a quick and hassle-free sale process. They provide a guaranteed best offer, pay cash upfront, and charge no commissions. You can sell your home as-is, avoiding the need for repairs or staging. These companies often provide same-day offers, which can save you time and reduce closing costs associated with a traditional sale. This option is particularly beneficial if you need to sell quickly or if your property requires significant repairs.

Tips for Buyers to Reduce Closing Costs

- Shop Around for Lenders: Different lenders have varying fees, interest rates, and terms. It’s beneficial to get quotes from multiple lenders and compare the costs. Look at the loan estimate form each lender provides. This document will detail the closing costs associated with their loan, making it easier to compare and choose the best deal. Don’t be afraid to negotiate with lenders either; sometimes they can offer lower fees if they know you’re shopping around.

- Negotiate with the Seller: In many cases, buyers can negotiate for the seller to cover part or all of their closing costs. This can be done through a seller concession, where the seller agrees to pay a certain amount towards the buyer’s closing costs in exchange for a higher purchase price. This strategy can significantly reduce the out-of-pocket expenses for the buyer at closing.

- Check for Available Grants or Assistance Programs: Florida offers several programs designed to help first-time homebuyers with closing costs. These programs may provide grants or low-interest loans that can cover part of your closing costs. It’s worth researching options like the Florida Housing Finance Corporation’s down payment and closing cost assistance programs. Eligibility criteria often include income limits and homebuyer education requirements.

Final Thoughts on Closing Costs in Florida

Understanding closing costs is key to a smooth real estate transaction in Florida. Knowing who is responsible and how much these costs typically amount to can help both buyers and sellers budget effectively and avoid surprises.

For sellers in Florida, they typically foot most of the bill, but some costs can be negotiated. Now, if you’re looking to sell your home the traditional way—it can take quite a bit of time, as well as cause you a lot of headaches.

At We Buy Houses Cash Florida, we’re known for providing the best price that’s right for you. You’ll also get hard cash right away, and the best part—you can sell your house as-is. If you’re looking to sell your house fast and lower your closing costs, then just click here and enter your number, or call (786) 386-5223.

FAQs About Closing Costs in Florida

What are normal closing costs in Florida?

Closing costs in Florida usually range from 2% to 5% of the home’s purchase price for buyers and 7% to 9% for sellers. Buyers often cover fees like loan origination, appraisal, title insurance, and recording fees. Sellers typically handle real estate commissions, title insurance, and documentary stamp tax.

How much are closing costs on a $300,000 house in Florida?

For a $300,000 house, buyers can expect to pay between $6,000 and $15,000. This includes loan origination fees ($1,500 to $3,000), appraisal fees ($300 to $500), title insurance ($1,500 to $3,000), and recording fees ($200 to $500). Sellers might pay $21,000 to $27,000, covering real estate commissions ($15,000 to $18,000), title insurance ($1,500 to $3,000), documentary stamp tax ($2,100), and other fees ($500 to $1,000).

Who pays closing costs in Florida, buyer or seller?

In Florida, both buyers and sellers share closing costs. Buyers usually cover loan origination, appraisal, title search, recording fees, and prepaids like homeowner’s insurance and property taxes. Sellers typically pay for real estate commissions, title insurance, and documentary stamp tax.

How do I calculate my closing costs as a seller in Florida?

To estimate your closing costs as a seller, consider these major expenses: real estate commission (5% to 6% of sale price), title insurance (0.5% to 1%), documentary stamp tax (0.7%), and other fees ($500 to $1,000 for settlement and recording). Add these together, which usually totals 7% to 9% of the sale price.

How much are closing costs in Florida if you pay cash?

If you pay cash, closing costs in Florida are generally lower since there are no loan-related fees. Expect to pay around 1% to 3% of the purchase price, which covers title insurance, documentary stamp tax, escrow fees, and other standard closing expenses.

What is the formula for calculating closing costs?

A quick way to estimate closing costs is to calculate 2% to 5% of the purchase price for buyers and 7% to 9% of the sale price for sellers. For more detailed estimates, add up individual costs like lender fees, title insurance, appraisal fees, and recording fees for buyers, and real estate commissions, title insurance, and documentary stamp tax for sellers.

What are the highest closing costs?

For buyers, the highest closing costs typically include loan origination fees (0.5% to 1% of the loan amount), title insurance (0.5% to 1% of the purchase price), and appraisal fees ($300 to $500). For sellers, the largest costs are usually real estate commissions (5% to 6% of the sale price) and title insurance (0.5% to 1% of the sale price).

What are the disadvantages of the seller paying closing costs?

When sellers pay closing costs, they might see a reduced net profit and lower negotiation leverage. Covering these costs might require adjusting the sale price to cover expenses, which can potentially limit buyer interest.

Who incurs most of the closing costs?

Both parties incur significant closing costs. Buyers typically pay more upfront fees, such as loan origination, appraisal, and inspection fees. Sellers often bear higher percentage-based costs like real estate commissions and title insurance, which can be substantial based on the sale price.